News

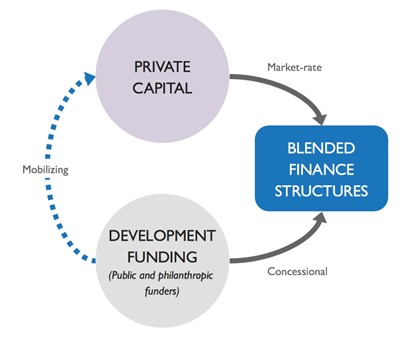

Small Foundation provides an array of flexible capital to a wide range of aligned stakeholders, including grants, debt, and equity. Our capital is often the first ‘catalytic’ layer in a blended finance structure; or perhaps funds a network or research which might lead to blended finance solutions.

While blended finance has been effective in supporting projects that might otherwise struggle to get off the ground or be sustained, it has limitations:

- Limited amounts of concessional capital: Ranges from capital focused exclusively on impact and willing to take a 100% loss, to capital willing to take additional risk or a lower financial return, there is a limited supply of this capital available.

- Complexity and transaction costs: Blended finance structures are complex, involving multiple stakeholders with different expectations. This often results in high transaction costs, which can deter smaller projects or those in less developed markets where such costs are harder to justify.

- Specificity of each transaction: Blended finance structures are often very specific to a particular context, time, and set of stakeholders., which may not be easily replicated

There are also risks:

- Market distortion and sustainability concerns: By providing subsidised funding, blended finance can distort markets and lead to an over-reliance on blended mechanisms.

- Uneven access: Blended finance tends to favour larger and more established players that have the capacity to engage in complex financing structures. Smaller enterprises, often those needing the most support in low-income countries, may be excluded.

- Focus on ‘bankable’ projects: There is a tendency within blended finance frameworks to prioritise projects that are likely to deliver financial returns. This can sideline projects that are less likely to generate profit, but crucial for developmental goals.

So the availability of blended finance is limited and there may be risks and downsides to using it. This poses the question, if it is to be used, where and when will it lead to the greatest change?

Leverage points within a system

In any complex system there are ‘leverage points’ – places where a small shift can lead to significant changes. Identifying these points requires a deep understanding of the system’s structure and dynamics, and even after identification there are challenges:

- Embracing uncertainty: Be prepared to experiment, learn from failures, and continuously adapt strategies. We cannot always predict how a system will respond to an intervention, but we can be proactive in learning and adapting as we go.

- Complexity and interconnectedness: Systems are intricate collections of actors that interact in dynamic and sometimes unpredictable ways. Recognising this helps us understand that changes in one part of the system can have far-reaching effects on other parts, emphasising the need for holistic interventions.

- Multi-level interventions: Systems operate at different levels, from individual behaviours to organisational practices and wider policies. Effective intervention strategies will address these levels simultaneously.

- Policies and practices: Given the dynamic nature of systems, policies and practices must be adaptive. This means designing interventions that can evolve alongside changing conditions, and setting up mechanisms for continuous learning to inform ongoing adjustments.

- Collaboration across sectors: Because systems encompass such a wide range of actors, effective intervention requires collaboration across sectors. Public agencies, private companies, non-profit organisations, and communities need to work together, sharing knowledge, resources, and strategies.

- Engagement with local stakeholders: Systems change requires deep, context-specific understanding and the engagement of local stakeholders. Blended finance initiatives can sometimes be driven by external agendas or models that do not fully integrate local needs and knowledge, leading to less effective interventions.

- Measuring impact: Blended finance projects often rely on quantifiable metrics that may not adequately capture broad, systemic impact, focusing instead on immediate, tangible outcomes.

Blended finance mainly addresses resource flows within a system: the movement of capital. Leverage points in the context of blended finance work alongside other aspects of systems change in different ways. Blended finance may follow from a change in policies as a market opens, or a blended finance transaction may act as a proof-of-concept that contributes to a policy change.

Ultimately to achieve systems change there needs to be a shift in mindsets, in ‘mental models’ – the certainties people have around a topic. This can be achieved by showing a different reality is possible: what was unprofitable needs to be shown to be profitable; what is not seen as an addressable market has to be shown to be addressable, and so on. For Small Foundation blended finance is a collaborative tool that can be deployed to show different realities are possible.